Key Points

- Filipino migrants frequently utilize bank-to-bank transfers and money transfer companies to remit money to the Philippines.

- In 2023, OFW remittances contributed 8.5 per cent to the Philippine Gross Domestic Product (GDP).

- With the emergence of digital currencies such as cryptocurrency, many Filipinos, like Wilma O'Brien from Young, NSW, remain uncertain and unprepared for these new forms of currency.

LISTEN TO THE PODCAST

Filipinos sending remittances to families back home

26:27

'Sent with love'

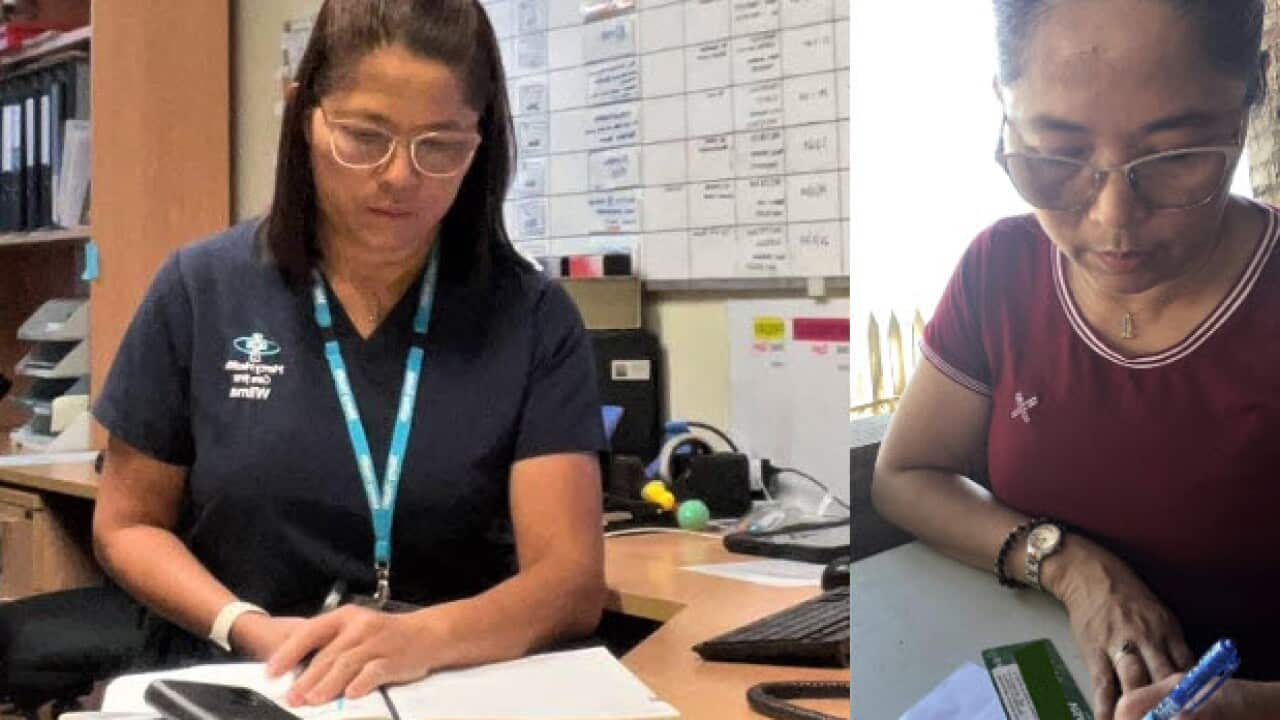

"I have been sending money to my family every month," aged care worker Wilma O'Brien shares.

Before 2019, Ms O'Brien usually sent financial support to her Dumaguete-based parents once a month, along with assisting other relatives.

"I send remittance every month, but it really depends on what they [my family] need."

However, in 2020, Wilma's father was diagnosed with an illness and his remittance became more frequent.

"When my daddy was diagnosed with Alzheimer's disease, a type of dementia, I would send more often, fortnightly minimum," the NSW South Western Slopes region resident looks back.

"Besides the regular payments for utilities, food and other necessities at home, I make sure that I am sending enough for my daddy's treatment."

The former hotel housekeeping worker has been living in Australia for seventeen years now. But before moving Down Under, she had a long experience as an OFW.

She was only 23 when she first worked abroad, she was a domestic helper in Singapore for 10 years before moving to Malaysia where she stayed for two years.

'Safe transactions'

"I've put in blood and sweat working overseas just to help my family," Wilma O'Brien remembers her frequent remittances.

For the Young, New South Wales resident, it's important to her to ensure that the support she sends for loved ones arrives safely.

"The money I send is for my dad's doctor fees and treatment and food for them [my mom and sister]."

Wilma used to send her remittances through the bank, but since discovering the convenience and speed of online money transfers, she hasn't looked back.

"It's really fast, within 10 minutes or so, they can receive the money."

"Thankfully I have not experienced any forms of scam," she reveals.

So far Wilma is happy using online money remittance services and has no intention of changing the way she sends remittances.

'Online and digital currency'

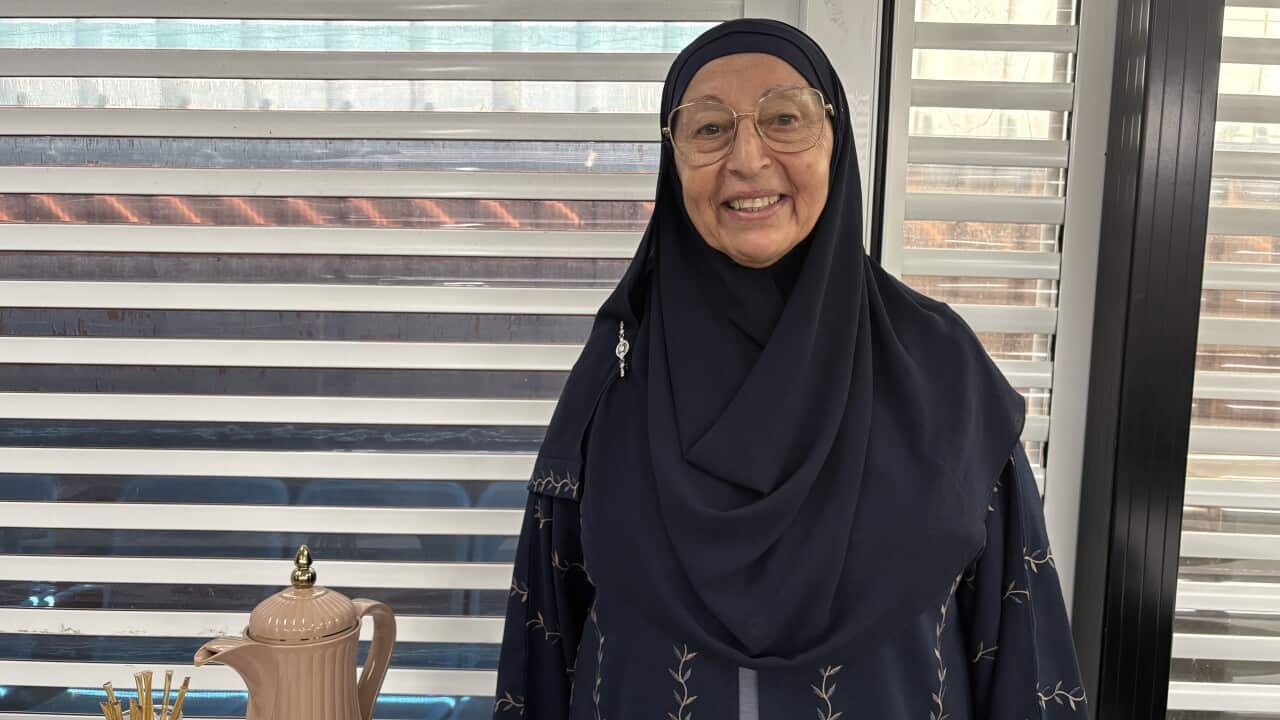

Ms O'Brien doesn't have a problem with online or digital money transfers, because she says that's what she's been using so far.

"I don't see any problem going cashless."

The only problem, she thought, was on the part of the recipient, in particular for the elderly.

"They are not like today's generations who are mostly tech-savvy, not everyone is good at digital or online, like my mum, she still withdraws money from the bank."

"Another consideration is if they don't have access to the internet."

When it comes to new forms of digital currencies, like cryptocurrency, Wilma O'Brien is not yet ready to try them.

"I've heard about cryptocurrency, but I don't pay much attention to it."

"I'm afraid because we're talking about our hard-earned money here and there might be some sort of scams that unscrupulous people try to utilise."

"I hear a lot about cryptocurrency but for now I am not interested in learning about it or how it works."