Key Points

- Arab Australian women are turning to gold as a safer way to invest spare funds.

- Gold jewellery is a traditional way to save money in the Middle East.

- Some women say cost of living pressures are curtailing their ability to buy gold.

SBS Arabic24 spoke to several women and a jeweller who claim Arab Australian women are seeking out pure gold jewellery as a safer way to invest spare funds.

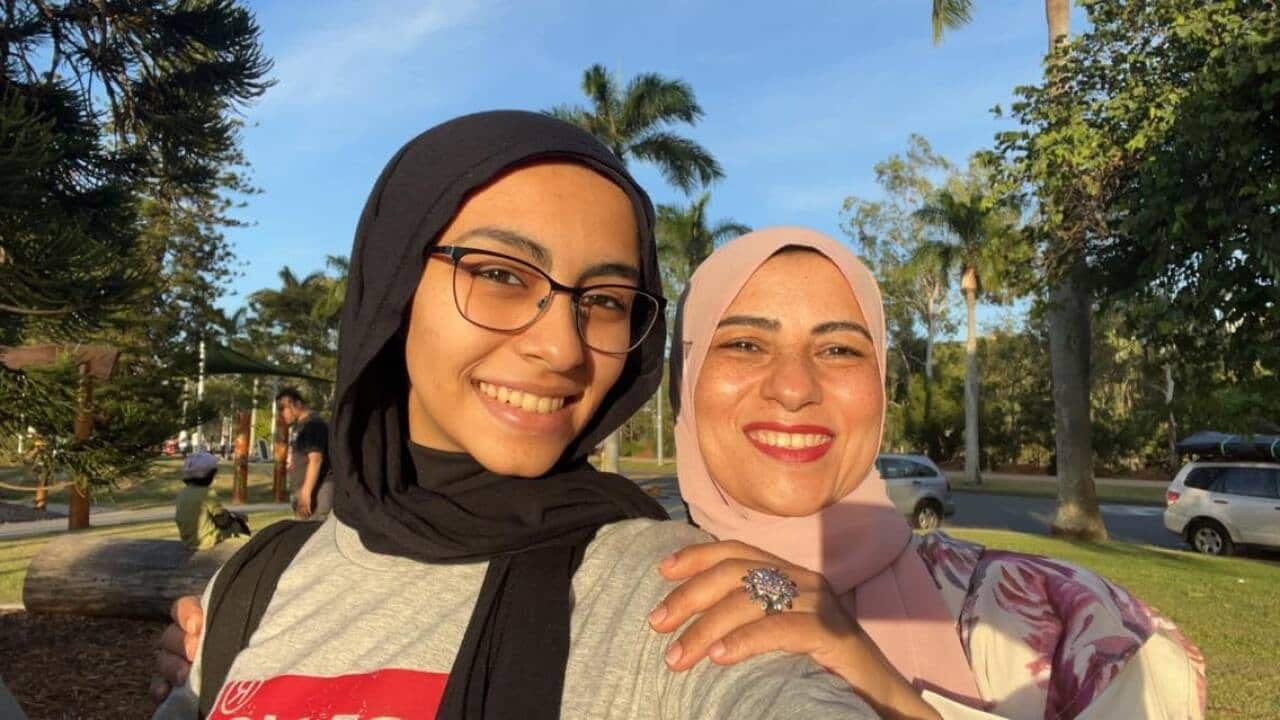

“Most, if not all, women in Egypt keep their savings in the form of gold jewellery,” said Teresa Magdy, a 34-year-old Egyptian immigrant who now calls Sydney home.

“This is what we were taught as we grew up.”

Gold jewellery has always been an part of Arab culture and a source of pride and prestige for lots of women.

More often than not, the precious metal is gifted for special occasions, particularly marriage.

But in Arab culture, gold jewellery is not only about adornment.

Gold jewellery on display at the Gold Souk in Kuwait City, Kuwait. Credit: Tim Graham/Tim Graham/Getty Images

Given its high monetary value and the relative stability of its price, gold is seen by lots of Arab women as a safe bet for saving and investing.

Gold is a kind of 'insurance policy'

Marie-Claire Bakker, an ethnographer with a special interest in the material culture of the Middle East, and Kara McKeown, a senior instructor in art history at Zayed University in the United Arab Emirates (UAE), gold jewellery as "an insurance policy".

Ms Bakker is one of the authors of the chapter in the book All Things Arabia, that describes the significance of the social role played by gold jewellery in Arab life.

"Gold is relatively safe from depreciation and, in the form of jewellery, it is both accessible and transportable by the woman herself," they wrote in the book published in 2020.

A lack of and currency devaluation in lots of countries in the Middle East has prompted women to place more value on their gold jewellery than on their money.

“I’ve seen people back in Egypt withdraw their money from banks to buy gold,” added Ms Magdy.

Gold is an especially attractive way to invest money in times of economic uncertainty. Source: Pixabay / Pixabay (Creative Commons)

It seems that there is a wide range of opinions.

Ms Magdy, a mother-of-one, said she was a bit sceptical about the quality of gold jewellery in Australia.

“It doesn’t seem to carry much value like what we used to buy back in Egypt,” she said.

“It’s not as nice and it’s so lightweight.”

An 'easy asset to own'

Asked why Arab women preferred gold to other forms of investment, Ms Magdy said it was an easy asset to own.

“How would (some) women understand how shares and other forms of investment work?” she wondered.

She said that monetising gold was straightforward and feasible for women.

Women invest in what’s within their grasp. Gold jewellery can be kept at home, and it can easily be sold if need arises.Teresa Magdy

“It also gives women a level of financial independence.”

According to , gold jewellery gives women autonomy by acting as "a cushion against potential divorce or abandonment".

"Every mother will make sure that her daughter is well-provisioned with sufficient gold jewellery to ensure her financial security," they wrote.

Cost of living pressures mean less 'spare cash'

Some women who spoke to SBS Arabic24 said they didn't have extra cash to buy gold jewellery with, especially amid the current inflationary climate.

“In Arab countries, middle-class women are more capable of saving than us,” said Iman Mouhamad, a Lebanese immigrant.

I hardly save and when I do, I don’t use my savings to buy gold jewellery.Iman Mouhamad

Ms Mouhamad blamed her inability to save on the high cost of living.

“I live in Sydney. That’s why I don’t save,” she said.

Ms Magdy also said she thought cost of living pressures made it difficult for Arab women in Australia to maintain their traditional saving strategies.

“The cost of living here in Australia is quite high compared to back in Egypt, especially if the family has to pay a mortgage or send their kids to private schools,” she said.

“Saving here to buy gold is a luxury that lots of people can’t afford.”

She said if she was able to save some cash, she would not buy gold jewellery.

“I’ll buy gold liras (gold coins) instead. It’s a better investment,” she said.

Despite the economic crunch that had rendered lots of families struggling to secure their everyday essentials, Amir Akkam, owner of Khalij Jewellery, said his business was booming.

Jewellery business is 'booming'

“Lots of people are putting their money in gold because of (and) not despite inflation,” Mr Akkam said.

“Some customers come to my shop every week or two to buy new pieces of jewellery.”

But Mr Akkam said that people’s tastes differed based on the purpose of the purchase as well as their cultural backgrounds.

“Arab women look for pieces that have more pure gold. They like yellow gold,” explained Mr Akkam, who said that 80 per cent of the customers of his Coburg-based business were Arabs.

“Western women don’t (tend to) wear that. They say it’s too yellow for them.”

Traditionally, people tended to rush into buying gold when they were concerned about other assets or the broader economy, and the current inflation hikes had elevated those worries, he said.

According to Mr Akkam, this is a smart choice.

In the last year alone, the price of gold has increased by 15 per cent.Amir Akkam

“How much interest do banks give their customers?”

Rana Bahous, a Syrian immigrant, said she and her friends regarded gold as a safe investment.

“Gold is safer than shares,” she said.

“I have a friend who buys gold liras one by one, then she swaps them for gold bullion (gold bars or ingots).

“This would be her personal savings. Nobody knows what the future holds.”

Please note this article has been prepared for informational purposes only, and is not intended to provide, and should not be relied on for, investment advice.