Abolishing the cashless debit card will not address issues with mandatory income management, an Indigenous financial services company has said.

Traditional Credit Union (TCU), which provides services for Indigenous people and organisations in remote Australia, told a parliamentary committee the proposal would simply shift people onto the more restrictive basics card.

"We don't agree with broad-based mandatory income management but we do agree with voluntary and targeted income management," TCU chief Tony Hampton said on Wednesday.

Mr Hampton said the TCU has been providing feedback and advocacy against mandatory income management for 15 years in the Northern Territory since the intervention, "why isn't anyone listening?"

"Once the bill goes through, then everybody that's on the cashless debit card has to go back to the basics card ... [it] doesn't actually achieve anything as far as we're concerned with moving away from broad-based mandatory income management."

A federal parliamentary committee heard from the Northern Territory Council of Social Service and other Territory organisations about an Albanese government plan to abolish the cashless debit card.

'Government-sanctioned financial abuse

The cashless debit card scheme is government-sanctioned financial abuse, a single mother placed on the income management program said.

Social exclusion, stigma and a lack of financial flexibility associated with the card had devastating mental health impacts for Kerryn Griffis and her daughters.

Ms Griffis told a parliamentary committee life became more difficult when she was placed on the card than it was before.

"You hear politicians banging on about how great it is and that 'it's a tough but necessary measure' but it's all rubbish," she said on Tuesday.

"They're either wilfully ignorant or they just don't care about the real-life impact this card is having on people.

"As a domestic violence survivor, I can tell you right now that the ... program is, simply put, government-sanctioned financial abuse."

Australia's social security system is belittling, impenetrably complicated and needs reform, the peak body for the Northern Territory community and social services sector said.

The NT Council of Social Services called on the federal government to abolish all forms of compulsory income management for people on welfare.

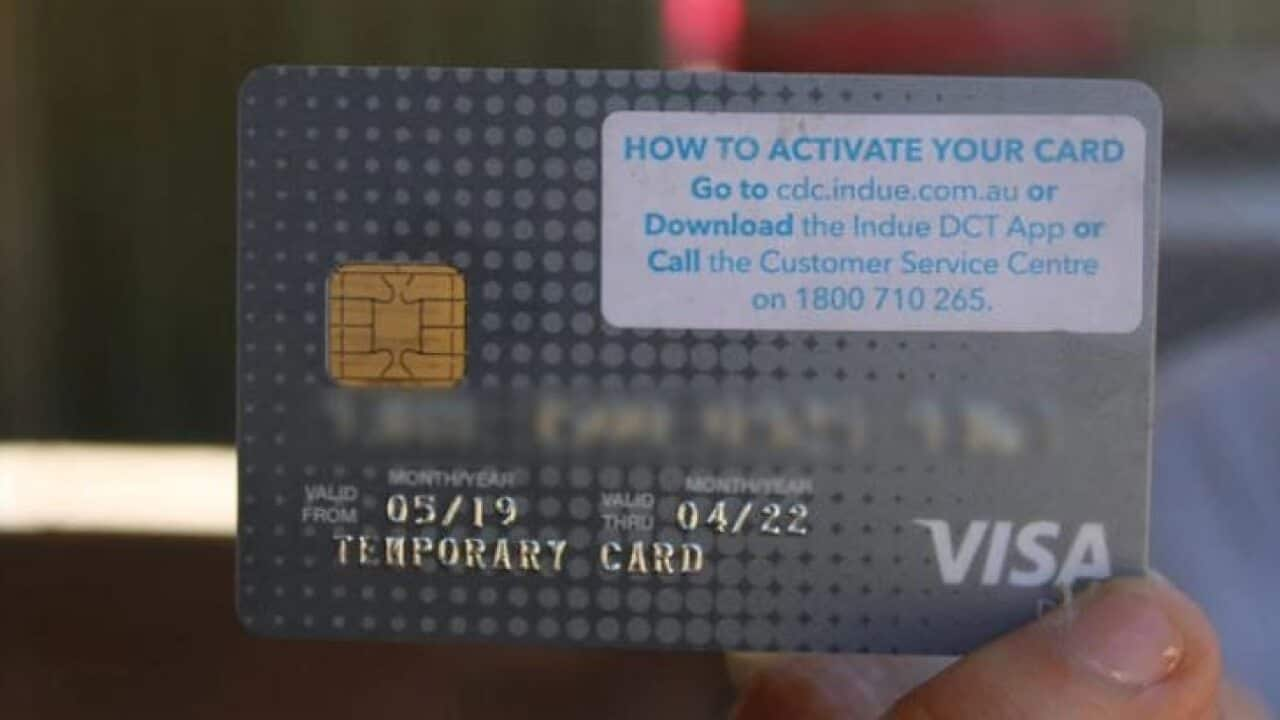

The debit cards were introduced by the Liberal-National coalition in 2016 and set up in several communities including, Ceduna in South Australia and Cape York in far north Queensland.

Under the scheme, up to 80 per cent of a person's welfare payment was added to a card and the funds could not be withdrawn for cash or spent on gambling or alcohol.

A return to the basics card

The proposal would shift about 3,800 people in the NT onto the basics card, Social Services Minister Amanda Rishworth said.

"This cashless debit card was effectively privatised welfare and wasn't working for many people," she told ABC radio on Wednesday.

"We will be consulting with communities into the future about the basics card."

But the basics card was not a good form of income management as it restricted shopping online, outside communities and made it obvious a person was on welfare, Mr Hampton said.

The Traditional Credit Union would rather people were able to stay on the cashless debit card voluntarily instead of abolishing it altogether.

"The debate here is not the cashless debit card ... it's about mandatory income management," Mr Hampton said.