Key Points

- Australia's GDP is expected to grow by 1.6 per cent in 2023, followed by 1.7 per cent in 2024.

- Despite the bleak outlook, Treasurer Jim Chalmers is confident Australia will avoid a recession.

- The state of Australia's economy depends largely on the RBA's cash rate decisions.

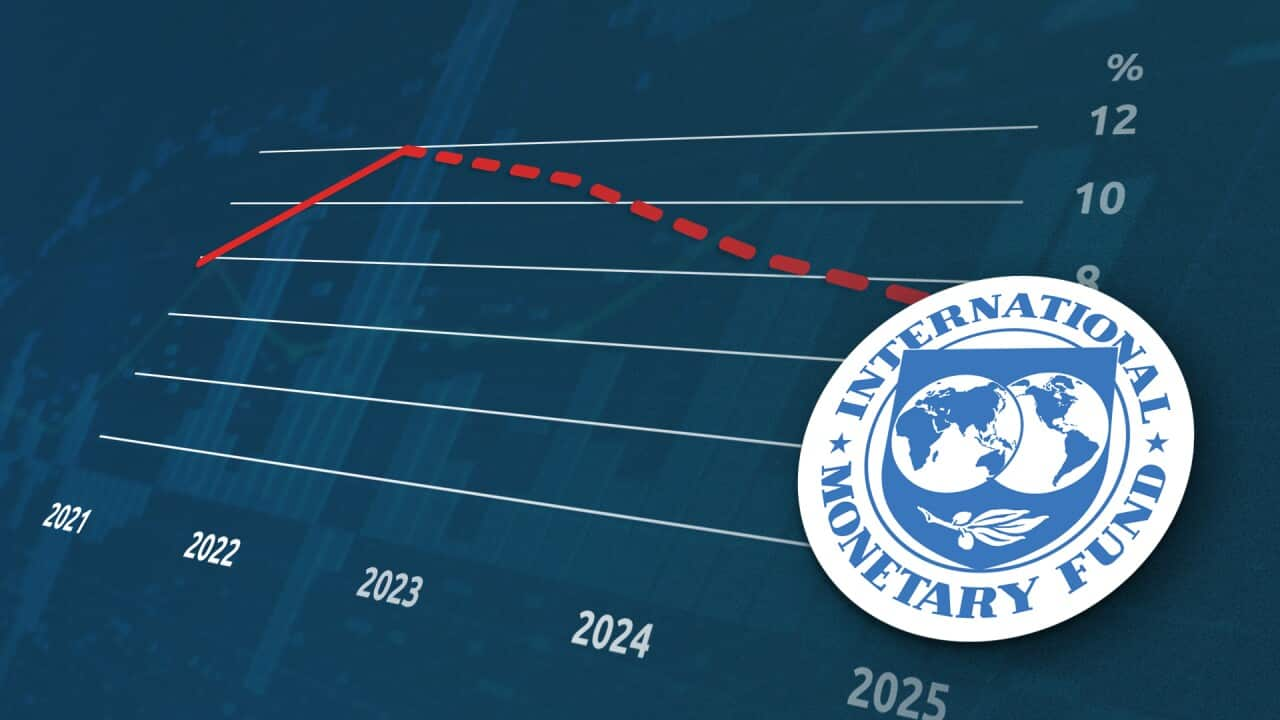

The global economy is entering a "perilous phase", with the International Monetary Fund (IMF) warning high inflation coupled with turmoil in the financial sector could bring near-recession conditions across the world.

In its latest global economic outlook, A Rocky Recovery, the IMF has predicted Australia's GDP growth would slow to just 1.6 per cent in 2023, followed by a 1.7 per cent rise in 2024.

Australia's forecasts were slightly ahead of those for the US and Canada, while the UK economy was expected to shrink this year.

Isaac Gross, economics lecturer at Monash University, said the financial slowdown facing Australia was "quite substantial".

"That's largely in response to the surge in inflation we've seen and the rising interest rates that the RBA has responded with," he told SBS News.

Could the Australian economy go into recession?

Treasurer Jim Chalmers said Australia wouldn't "be immune from a global slowdown", but the nation was on track to avoid a recession.

"We are better placed than most countries because of lower unemployment, because of the prices we're getting for our exports and some of the other advantages we have," he told ABC Radio on Wednesday.

Mr Gross said while there was "definitely a higher probability" of Australia going into a recession now than there was three months ago, he agreed that it was unlikely.

"A period of weak growth … where the economy only slowly grows, seems the most likely outcome," he said.

"The unemployment rate is still very low … if a recession were to occur, we'd expect that to rise substantially.

"I think if we make it out of 2023 without a recession, we're probably in the clear."

What could the IMF's outlook mean for interest rates in Australia?

Inflation is currently sitting at 6.8 per cent in Australia, with the IMF not predicting a return to the RBA's target of between 2 and 3 per cent before 2025.

"At the moment, the markets are thinking there's probably either no more or from the Reserve Bank, and then maybe in a year's time, interest rates will start to come down a little bit," John Hawkins, senior lecturer in the University of Canberra's School of Politics, Economics and Society told SBS News.

"But if inflation stays stubbornly high, the Reserve Bank will have to increase interest rates by more and leave them high for longer."

That would make a recession more likely, Mr Hawkins said.

While "recessions are not to be hoped for", Mr Gross said there could be "one upside" for .

"If the situation is as dire as the IMF thinks, that means that the RBA will be less inclined to increase interest rates, and we might see some decreases in the RBA cash rate earlier than expected," he said.

What could the outlook mean for rising rents?

Mr Gross said recent data indicated rents across the country were still rising at "an incredibly rapid pace".

"Even if you've got a rental contract that you signed six months ago, when you go to renegotiate it in six months' time, perhaps, there's a good chance that you'll see a big increase in your rent," he said.

"I think it's going to be pretty dire for the next year on the cost of living front, if only because of the rental prices, even if oil prices end up becoming a bit cheaper."

Mr Hakwins said the rise in rental prices is largely being driven by the lack of available housing, not landlords passing interest rate rises onto their tenants.

"They may well use that as an excuse, but essentially, landlords will put up the rent if the vacancy rate is low. If its tenants have nowhere else to go, they'll put the rent up, if tenants can easily find another place, they won't," he said.

"The rule of thumb is a 3 per cent vacancy rate is a reasonable sort of balance, but it's much tighter than that almost across the country."

What can the government do?

Mr Gross said the government should continue to deploy the "anti-inflation policies they have to try and bring costs down".

"Whether it's the cap on gas prices — I think that's a positive move by the federal government — and then just not doing anything too crazy in the budget in terms of overstimulating the economy," he said.

Deputy Liberal leader Sussan Ley said next month's federal budget should include measures to help counter the impacts of inflation.

"There's a feeling people have been left behind," she told Sky News on Wednesday.

"It's so important the government gets this budget right."

Additional reporting by AAP