Key Points

- More than 5,000 Australians have been alerted to a romance scam operation that may have targeted them.

- Australians lost more than $23.5 million to romance scams in 2024, according to Scamwatch.

- There are a number of warning signs someone you've met online could be trying to scam you.

Alerts have been sent out to 5,000 potential scam victims in Australia, warning they may have been targeted by romance scammers based in the Philippines.

Australia's National Anti-Scam Centre and the Joint Policing Cybercrime Collaboration Centre, led by the Australian Federal Police (AFP), issued text alerts to the potential victims, who are mostly male.

The alerts warned against sending money to people they have met online and provided steps for those who have already been scammed.

Philippine authorities uncovered a scam operation compound in central Manila in November 2024, seizing over 300 computer towers, 1,000 mobile phones, and thousands of SIM cards.

Evidence from the raid was shared with international law enforcement to identify victims, including those unaware they were targeted.

In November 2024, Philippine authorities uncovered a scam operation in central Manila, seizing over 300 computer towers, 1,000 mobile phones, and thousands of SIM cards. Source: Supplied / Australian Federal Police

"If it feels too good to be true, it probably is," he said.

"There are many warning signs someone you've met online could be trying to scam you. In this case, the scammer would ask to move the conversation from an online dating app to an end-to-end encryption messaging platform."

Besides investment scams — which claimed more than $192 million — romance scams were among the methods most responsible for the lost money.

Romance and dating scams were responsible for more than $23.5 million lost in 2024, according to the government's Scamwatch service. The median amount lost to romance scams was around $1,600.

How did the scam work?

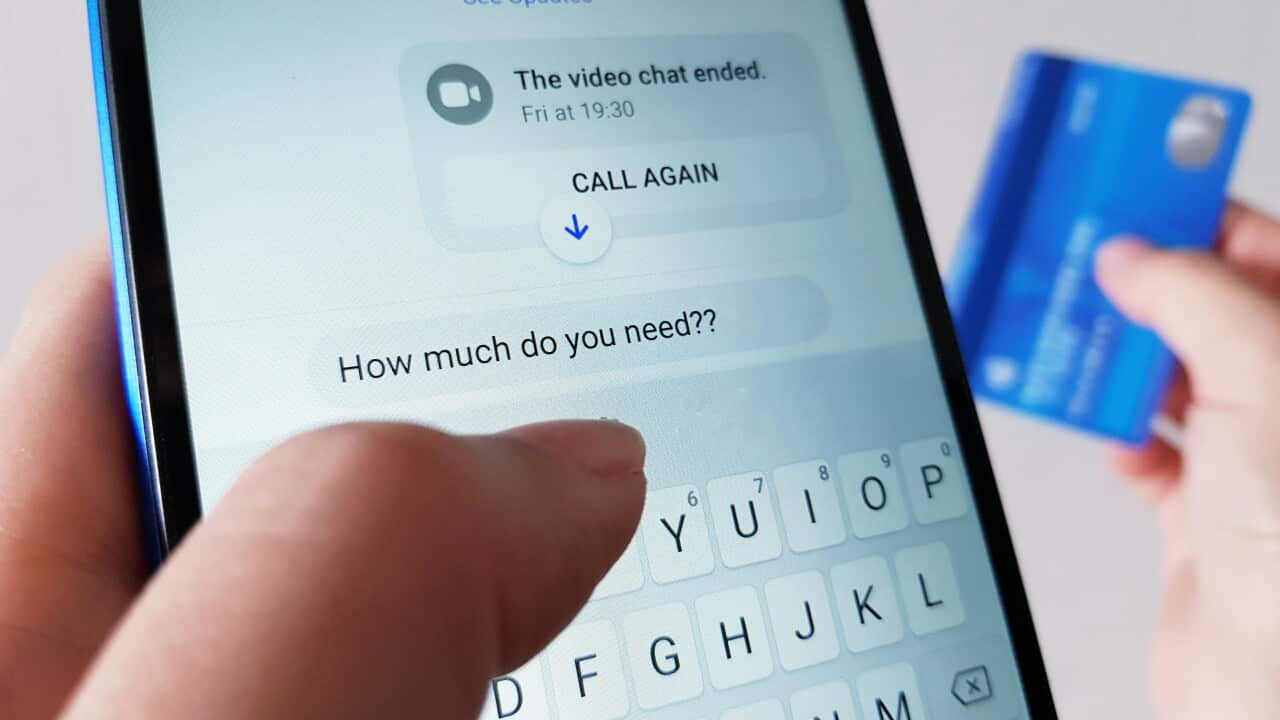

The scammers allegedly used dating apps to trick victims into a fake online romantic relationship before convincing them to buy legitimate cryptocurrency.

They would then ask for a minimum first investment of between $300-$800 before encouraging the victim to invest more.

The victim would then be talked into transferring funds from the legitimate crypto account into the scammer's personal bank account. Over 5,000 Australian phone numbers were linked to messages found on encrypted devices.

Most of the victims targeted were men over the age of 35. The fraudsters posed as either a Filipino woman working in Australia or a resident in the Philippines.

Australian Competition and Consumer Commission deputy chair Catriona Lowe said .

"Criminals build trust over time and often abuse this trust by encouraging people to make large investments, leaving victims with significant financial losses and emotional distress," she said.

"We encourage people to always independently verify any investment opportunity via trusted sources such as an Australian registered financial adviser."

Here's what you can do if you've been scammed

Hundreds of thousands of Australians lose money or personal information to scams every year.

If you've been scammed, here are some steps you can take to reduce the damage and prevent further losses.

- Act fast to prevent further losses: Contact your bank or card provider immediately to report the scam. Ask them to stop any transactions.

- Get help to recover: If you're not happy with how your bank has responded to your situation, you can complain to the Australian Financial Complaints Authority.

- Warn others and report the scam: Once you have secured your details, you can warn others by reporting the scam to Scamwatch.

- Watch out for follow-up scams: If scammers have stolen money from you, they often return for more. Unfortunately, one in three victims of fraud has been scammed more than once, according to Scamwatch. Also, look out for new scams — especially someone offering to help you get your money back.

- Get support: Being scammed is a horrible experience, and it can happen to anyone. If you need someone to talk to, contact family and friends or speak to a financial counsellor about debt-related issues.