Key Points

- Inflation is currently at 6.1 per cent.

- Jim Chalmers predicts it will reach 7.75 per cent this year.

Inflation is expected to spike to 7.75 per cent by the end of the year, leapfrogging earlier forecasts by a significant margin, Treasurer Jim Chalmers has warned.

Here's what the treasurer said on Thursday as he delivered a ministerial statement to federal parliament - and what the latest inflation figures mean.

What did Mr Chalmers say?

Mr Chalmers said the economic growth outlook has been pared back, announcing that inflation is tipped to reach 7.75 per cent by the end of the year.

"Australians are paying a hefty price for a wasted decade," he told MPs, as he lashed the Opposition over its time in government.

Three months ago, Treasury was forecasting inflation to peak at 4.25 per cent this year.

What is inflation now?

"It's already 6.1 per cent through the year to June, and now forecast to peak at 7.75 per cent in the December quarter this year," Mr Chalmers said.

"The current expectation is that it will get worse this year, moderate next year, and normalise the year after.

"We haven't reached the peak yet - but we can see it from here."

When will this peak pass?

Treasury is forecasting inflation to fall to 5.5 per cent by mid-2023 and to 3.5 per cent by the end of next year.

In mid-2024, it is expected to reach 2.75 per cent and be within the Reserve Bank of Australia's preferred 2 to 3 per cent target band.

"Inflation will unwind, but not in an instant," Mr Chalmers said.

"Just as the domestic forces contributing to some of the supply side pressures have been building for the best part of a decade, it will take some time for them to dissipate - but they will.

"In the meantime, higher interest rates, combined with the global slowdown ... will impact on Australia's economic growth."

What about the Australian economy?

Treasury has also slashed its gross domestic product forecasts for 2021/22, 2022/23 and 2023/24 by half a percentage point each.

Growth is now expected to have hit 3.75 per cent in the last financial year. The official outcome for the year will not be released by the Australian Bureau of Statistics (ABS) until September.

The economy is expected to grow by 3 per cent this year and by 2 per cent next year.

"A key part of this weaker growth outlook is due to weaker consumption, reflecting higher inflation and higher interest rates," Mr Chalmers said.

The treasurer said while the revisions reflected choppy economic waters and slowing global growth, he put much of the blame on the Opposition.

He accused the former Coalition government of glossing over and burying bad news for political gain.

"That approach has already given our country a wasted decade of missed opportunities and messed up priorities," he told lower house MPs.

"You [the Australian people] are already paying too much for that in the form of high and rising inflation, falling real wages and a trillion dollars of debt that will take generations to pay off."

While Mr Chalmers' statement did not focus on budget forecasts - he is saving that for a new Labor budget in October - it does paint a picture of what Australians can expect when it comes to the bottom line.

Vegetable prices are soaring in Australia Credit: SBS News / Sandra Fulloon

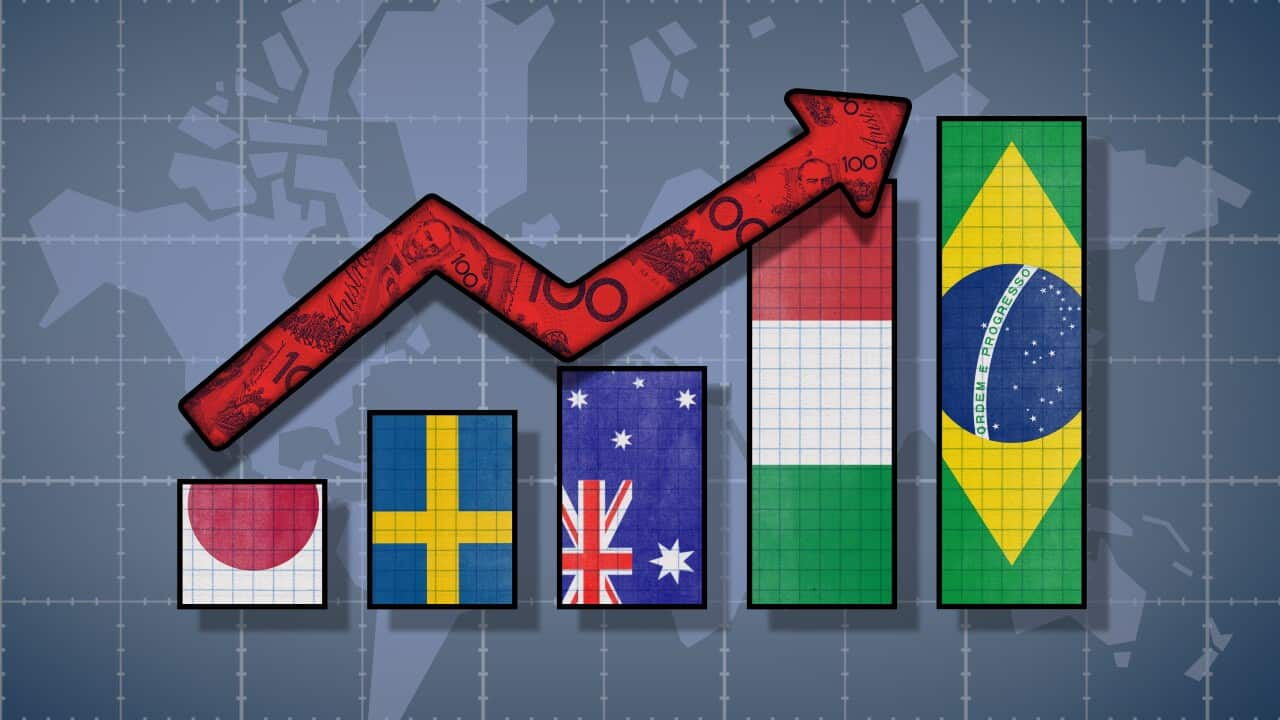

Is Australia alone in doing it tough?

While inflation is the highest it has been in Australia in over 20 years, that considering the war in Ukraine and the COVID-19 pandemic, the country is not faring too badly.

Australia still has a much lower inflation rate than other countries in the G20 at the moment, such as the United Kingdom at 9.4 per cent or the United States at 9.1 per cent.

"If most of the inflation has been caused by these kinds of world shocks, it's not a surprise that most countries are experiencing high levels of inflation," economist Matt Grudnoff said.

"If we look at the G20 countries, Australia is near the bottom ... Most of the G20 are actually higher than us. So we don't have as stronger inflation as the rest of the world."