Key Points

- Police have arrested a man who allegedly obtained a "substantial amount of money" via the ‘Hi Mum’ scam.

- The scam involves perpetrators sending messages to victims, claiming to be loved ones in need of money.

- Over 11, 000 incidents were reported in Australia in 2022, amounting to losses of over $7.2 million.

In 2022, Australians are believed to have lost over $7 million through the now-notorious ‘Hi Mum’ text scam, which dupes victims into sending money to cybercriminals posing as their children.

Now, Victorian police have arrested a man for obtaining a “substantial amount of money” through the scam.

So what are the ‘Hi Mum’ messages, why is the scam so effective, and how can you spot it?

What is the scam?

The 'Hi Mum' text scam is simple, but effective.

Perpetrators send a message, usually via WhatsApp or SMS, posing as a friend or family member who has either lost their phone or got a new number.

The scammers then claim to be locked out of their online banking system, and ask the victim to send money.

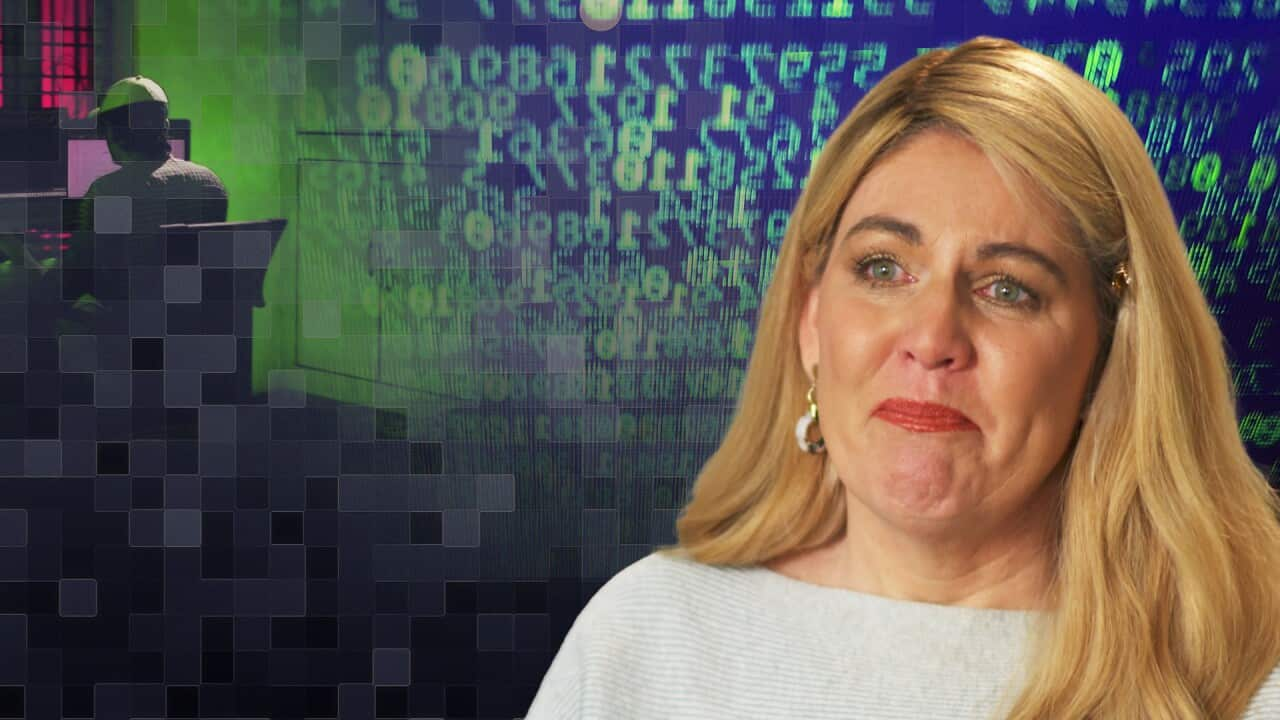

The WhatsApp message received by Liz Lawson from who she believed to be her daughter.

According to December figures from the Australian Competition and Consumer Commission (ACCC), over 11, 000 incidents were reported in 2022, amounting to losses of over $7.2 million.

Melbourne man arrested

On Friday, police in Doncaster, Melbourne, confirmed a man had been arrested and charged over online scam incidents.

The man allegedly obtained a "substantial amount of money" through the 'Hi Mum' scam, along with purchasing electronic goods via false documents.

The charge came after a six-week investigation.

The scam remains popular around Australia and internationally, and police are urging the public to become more informed of both current and emerging scams.

Who is falling victim to the scam?

According to the ACCC, over two-thirds of incidents are reported by women over 55.

“Unfortunately, these unscrupulous scammers are targeting women and older Australians, with 82 per cent of family impersonation scams reported by people over the age of 55, accounting for 95 per cent of all reported losses,” ACCC Deputy Chair Delia Rickard said.

Perth woman Liz Lawson knows this all too well.

She fell victim to the scam after receiving a message from someone posing as her daughter, who was working in the United States at the time.

“It was a lengthy distressed message claiming she had dropped her phone in the toilet and it no longer worked because of water damage so she said she had borrowed a phone and got a new SIM card,” the 53-year-old said.

“It was also very convincing because she’s been working on a boat, she’s lost and damaged her phone before, particularly water damage, and she’s asked me to make payments for her before, quite recently when she was buying new camera equipment.”

The scam cost her almost $10,000.

Her bank was later able to refund her the full amount, but many victims are not able to get their money back.

How can you protect yourself from scams?

The ACCC urges people who receive suspicious messages from a number they don’t recognise to independently verify the contact.

"If you’re contacted by someone claiming to be your son, daughter, relative or friend, start by calling them on the number already stored in your phone to confirm if it’s no longer in use. If they pick up — you know it’s a scam,” Ms Rickard said.

“If unable to make contact, you should try a secondary contact method to verify who you’re speaking to. If you still can’t contact your family member or friend, consider asking a personal question a scammer couldn’t know the answer to, so you know the person you are speaking to is who they say they are.”

Scamwatch also advises careful consideration and checks before sending money to anybody, and to think twice before clicking on unsolicited links, even if they appear to come from a business or person you trust.

To keep your accounts secure, Scamwatch recommends using strong passwords, regularly updating security software, and enabling multi-factor authentication if possible.