Key Points

- The Coalition will support Labor's stage three tax cut changes, with Peter Dutton acknowledging Australians are "doing it tough".

- Australians earning less than $150,000 will receive a greater tax cut under the revised plan.

- The changes will be debated in parliament but are expected to come into effect on 1 July.

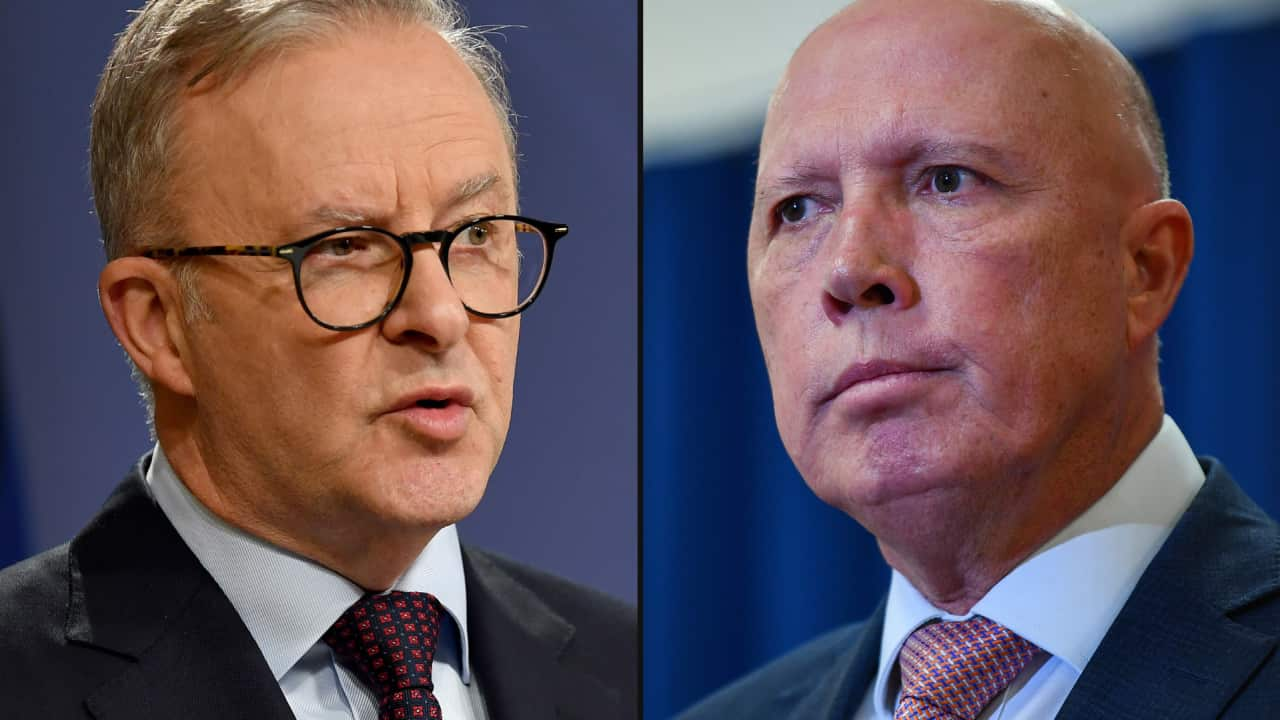

Opposition leader Peter Dutton has confirmed the Coalition will back the government's stage three tax cuts, while taking aim at Prime Minister Anthony Albanese.

The changes are set to benefit low and middle-income earners but the Opposition criticised Albanese over the move, saying he broke an election promise.

Dutton revealed the Coalition "will not stand in the way of Australians doing it tough" after a party room meeting on Tuesday morning.

"We are supporting this change not to support the prime minister's lie but to support those families who need help now," he said.

Dutton called Albanese an "egregious" liar for the amendments and committed to "significant tax policy which will reduce taxes for Australians" at the next election.

The revised package will be presented to the House of Representatives on Tuesday as federal parliament meets for the first sitting day of 2024.

The decision means the government won't have to negotiate with either the Greens or the crossbench to pass the tax cut changes.

Here's what you need to know about the tax cuts.

Albanese promises tax cuts for 'every Australian'

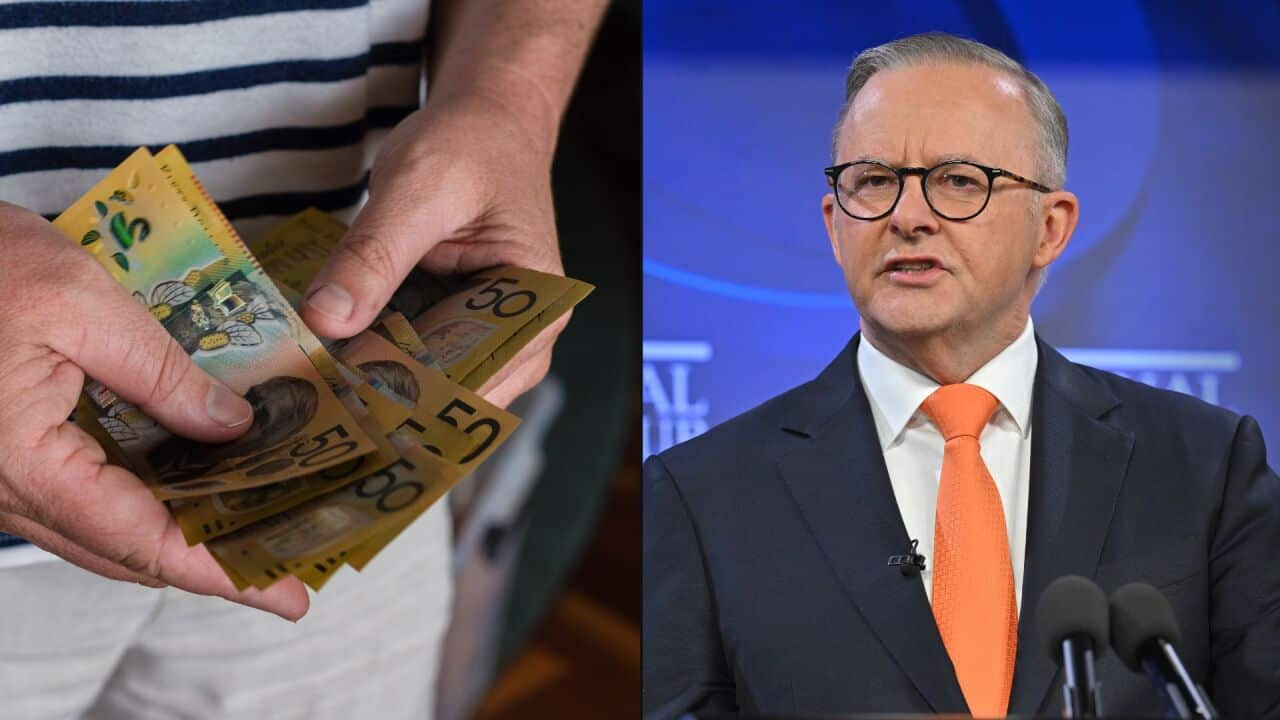

Australians earning up to $150,000 are expected to get a cash boost under the revised stage three tax cuts plan announced by Labor in late January.

The federal government says the revised plan will help "middle Australia" with cost of living pressures.

Workers earning more than $150,000 will receive a tax cut, but it won't be as generous as initially forecast.

A person earning an average wage of $73,000 will get a tax cut of more than $1,500 a year, while those earning $50,000 will pocket an extra $929 a year.

At the upper end, the stage three tax cuts for those earning $200,000 will be slashed from $9,075 to $4,500.

Albanese had signalled he would want to see the changes pass parliament by Easter before coming into effect in July.

Source: SBS News / Kenneth Macleod

He said the changing global circumstances — including the pandemic and global inflation spikes — could not be ignored as Australians struggled with cost of living pressures.

Which Australians benefit from the revised stage three tax cuts?

New economic analysis shows electorates held by Nationals MPs would gain most from the altered policy.

Findings released by the Australia Institute reveal voters in Nationals-held electorates would receive a $326 cut, while those in Liberal seats would be $226 better off.

Voters in electorates held by the government would receive an extra $229 per person.

- with additional reporting from AAP