Key Points

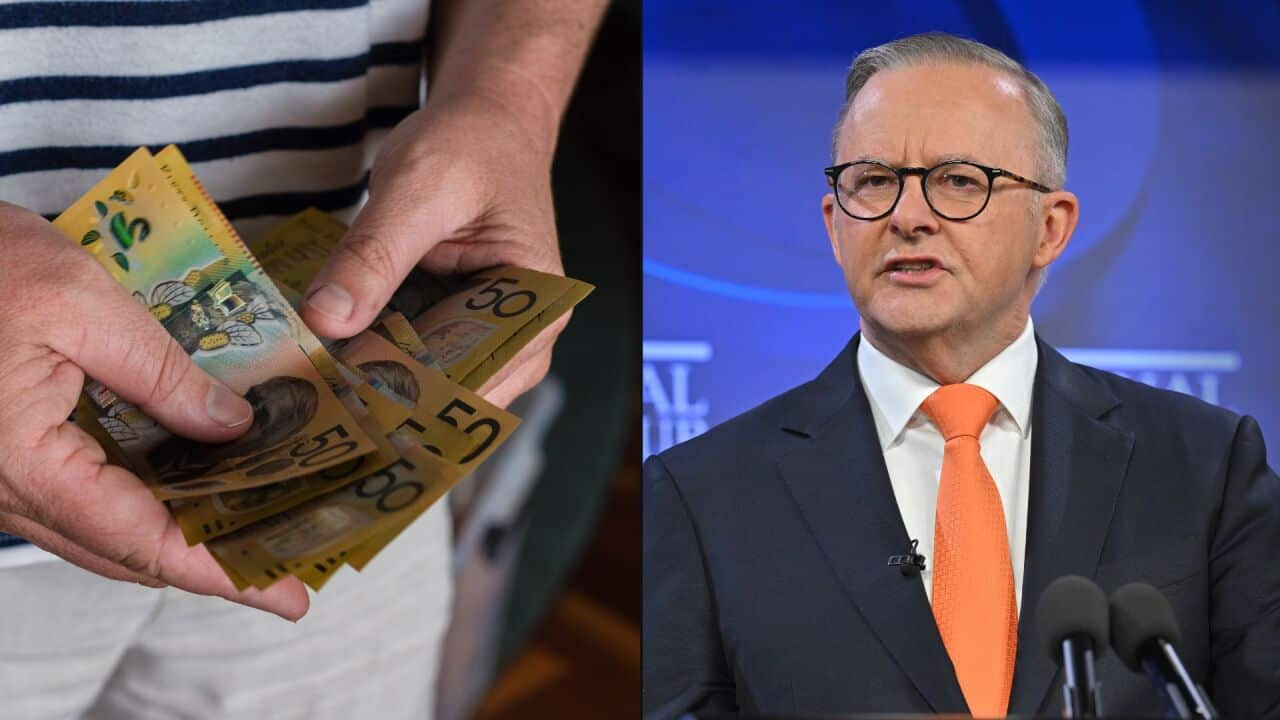

- Prime Minister Anthony Albanese is hopeful his government's changes to stage three tax cuts will pass parliament.

- Under the amended scheme, workers earning less than $150,000 will receive a larger tax cut.

- The changes will need the support of Senate crossbenchers to be legislated before the cuts come into effect in July.

Prime Minister Anthony Albanese remains confident changes to stage three tax cuts will be passed into law, despite needing the support of crossbenchers to pass on the financial relief.

Under the reworked tax plans, those earning less than $150,000 a year , while those earning more will receive a smaller tax break than in the original plan taken to the 2022 election.

The prime minister said to the tax plans, first legislated by the former coalition government in 2019, following cost-of-living pressures and higher-than-expected inflation.

While the tax changes will need the support of Senate crossbenchers to be legislated before the cuts come into effect in July, Albanese said he was hopeful the plan would pass parliament.

"We will put it to the Senate, and I'm very confident that people will look at the two plans which are there, one of which leaves a whole lot of people behind ... we'll give (average earners) double the tax cut. We are determined to argue our case," he told Sky News on Sunday.

"We are putting our plan to the parliament, and we are hopeful of getting support."

Greens leader Adam Bandt has to ensure low and middle-income earners get greater financial relief.

Albanese has come under criticism from the opposition for the changes to the stage three tax cuts, after previously committing to the original package.

But he said the changes were needed due to the economic circumstances.

"I have a responsibility to show strength, and one of the things that I've said is that this isn't an easy decision, but it's the right decision," he said.

"We're being very cautious about spending, because the challenge for us is to assist people in the immediate without being counterproductive, and if we just increase spending then it can be counterproductive."

Source: SBS News / Kenneth Macleod

He flagged consideration would be made for further cost-of-living support measures ahead of the 2024 federal budget.

Opposition says prime minister is in 'panic mode'

The federal Opposition has yet to state whether they would repeal the proposed stage three changes should they form the next government.

Opposition leader Peter Dutton said middle-income earners would end up paying more in tax in coming years due to bracket creep.

"When the government came into power, they abolished the low and middle-income tax offset, which means that people on low and middle-incomes now are paying more tax than they were under the coalition government," he told reporters in Hobart.

"The prime minister is obviously in panic mode.

"There's a Dunkley by-election coming up in Victoria on March 2. He's worried people have seen him distracted over the course of the last 18 months."

Albanese said the by-election was not a factor in rolling out the tax changes.

"We have ... a responsibility to do the right thing. And that's precisely what we have done here, making a difference for people," the prime minister said.

Deputy Liberal leader Sussan Ley said the opposition would examine the legislation to determine its stance.

"Our position is that the tax relief everyone was promised under stage three, that tax relief is what people should get," she told Sky News.

"We will look at whatever comes in front of us ... we have to go through the fine print on everything. We have to look very carefully at all of the numbers because what this is is a lifetime tax on aspiration."