Key Points

- Australia's rental crisis is turning some international students into homeowners.

- Overseas homebuyers in Australia need to pay for additional costs beyond the purchase price of the property.

- Expert says buying instead of renting is not a sustainable solution to Australian housing crisis.

Some international students are choosing to buy rather than rent due to the pressure of Australia's escalating rental crisis.

Tina Teng, a 23-year-old international student from China, is one of them.

In September, she moved into a two-bedroom, two-bathroom apartment in South Melbourne that her parents bought for her for more than $900,000 this year.

Before that, she was renting a one-bedroom, one-bathroom apartment in the inner Melbourne suburb of Southbank for $2,760 a month.

Ms Teng tells SBS Chinese that she started thinking about buying a place after her landlord asked for an "unacceptable" rent increase.

My landlord asked to increase the rent by $200 per week, and I think (that) is too high to accept.Tina Teng

“I thought I might as well buy my own place,” she says.

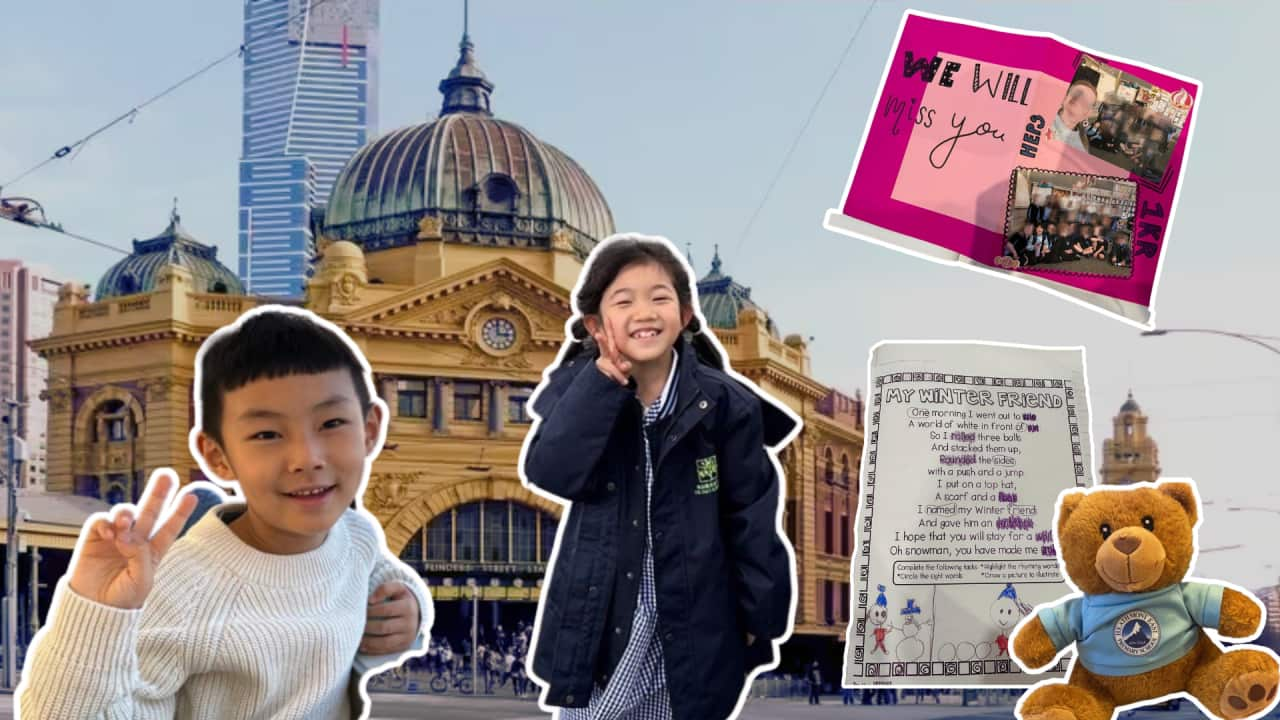

Tina Teng, an international student, says rising rents have prompted her to turn to the buyer's market. Source: SBS / Shan Kou

In the 12 months to June 2023, median advertised rents increased by 11.5 per cent in Australian capital city areas, with strong increases in Sydney, Melbourne and Perth (13 per cent in each city), according to.

Meanwhile, Australia's national vacancy rate (1.1 per cent), making it even harder to find accommodation.

‘I feel much more secure’

Vietnamese student, Linh Vu, is in her second year at Monash University. In February, she moved into an apartment which her parents bought for her last year.

The 20-year-old says she had a "tough" renting experience when she first arrived in Australia last February. Due to the limited time she had to find a place, she says she ended up in a house far away from the CBD.

I feel much more secure (now) that I actually own a place.Linh Vu

“Last year, I had to (deal with) [rental] applications, descriptions and renting history,” she says.

Linh Vu, an international student in Melbourne, says she feels much more secure now that she has her own place. Source: SBS / Shan Kou

“I just (did a) video call with them and showed them the videos of the house and then they said 'OK. Just go ahead'.”

She ended up buying a two-bedroom, two-bathroom apartment near South Melbourne for $780,000, which was expensive when compared to property prices in her home country, she says.

They [my parents] were sceptical about it [the price] at first. They said that compared to Vietnam, the price was very high.Linh Vu

“But then I showed them the other projects to show them the average price. It [the apartment I got] was the best one,” she says.

Additional cost for foreign buyers

As a foreign homebuyer, Ms Vu paid extra costs beyond the purchase price of the property, including additional stamp duty and Foreign Investment Review Board (FIRB) fees.

Overseas homebuyers in Australia may incur additional costs beyond the purchase price of the property. Source: AAP / AAP Image/LUIS ASCUI

For example, the for a residential property worth $1 million or less increased to $14,100 from 1 July 2023.

In addition, overseas buyers have to add an extra 8 per cent stamp duty on top of the 5.5 per cent for local buyers in Victoria.

Ms Vu tells SBS Chinese that the extra cost is “very high” for a foreign buyer, but she believes it was a worthwhile investment process.

As international buyers, we have to invest a lot of capital and (incur) the currency (exchange) as well.Linh Vu

“But since the process is very secure and the rental yields capital gains every year. I think it's worth buying,” she adds.

However, Mark Humphery-Jenner, associate professor of Finance at UNSW, reminds potential overseas investors to consider risk in identifying which properties to buy and whether the asset is good value.

"They [foreign buyers] risk unscrupulous individuals selling them properties for too high a price, which would then cause them to lose money when they go to sell," he tells SBS Chinese.

Foreign investors are back in the property market

Industry insiders suggest that foreign investor interest in the Australian property market is picking up.

The from industry analysts, Juwai IQI, shows that Australia is the top destination for Chinese cross-border home buyers, followed by Canada, the United Kingdom and the United States.

Victor Wu, managing director of a Melbourne-based real estate investment company, says their sales to overseas buyers have recovered to 60 per cent of the pre-pandemic level, and over 50 per cent of them come from China.

Industry insider, Victor Wu, says foreign investor interest in the Australian real estate market is picking up. Credit: SBS: Nicole Gong

The enthusiasm of Chinese buyers to invest in the Australian housing market is undiminished.Victor Wu

“We sell five to six properties per month to Chinese overseas buyers on average since (China borders) reopened this year,” he adds.

It is believed that China's decision to reopen its borders in early January has added to the strong demand for Australian properties.

A subsequent edict by the Chinese government requiring foreign-enrolled students to return to campus for face-to-face study further boosted buyer demand.

The latest show that buyers from China dominate foreign investment in Australian residential real estate, with $700 million in proposed purchases approved from 1 January to 31 March 2023.

The next two largest sources of residential investment were Hong Kong ($100 million) and Vietnam ($100 billion).

In the first quarter of 2023, China was the largest source of investment for approved residential real estate investment proposals in Australia. Credit: Treasury.gov.au

Buying not a solution for everyone: expert

Ms Teng and Ms Vu have both turned to buying a home to escape the rental crisis, but an expert says it is not a solution for everyone.

“There are many young people who cannot afford to buy a place due to the high price,” Dr Song Shi, associate professor in real estate at the School of Built Environment at the University of Technology Sydney, says.

In fact, the trend could actually just shift the rental crisis to the housing supply crisis, he adds.

Dr Shi says he doesn't recommend international students buy a property during their studies, so that they can have more flexibility to make the decision after graduation.

“People will face a number of uncertainties after graduation, including where they will live and what they will do for a living, and having a house can be a constraint (on) their career prospects,” Dr Shi says.

“Don't let (owning a) house limit your life choices.”